Introduction to AI in Insurance

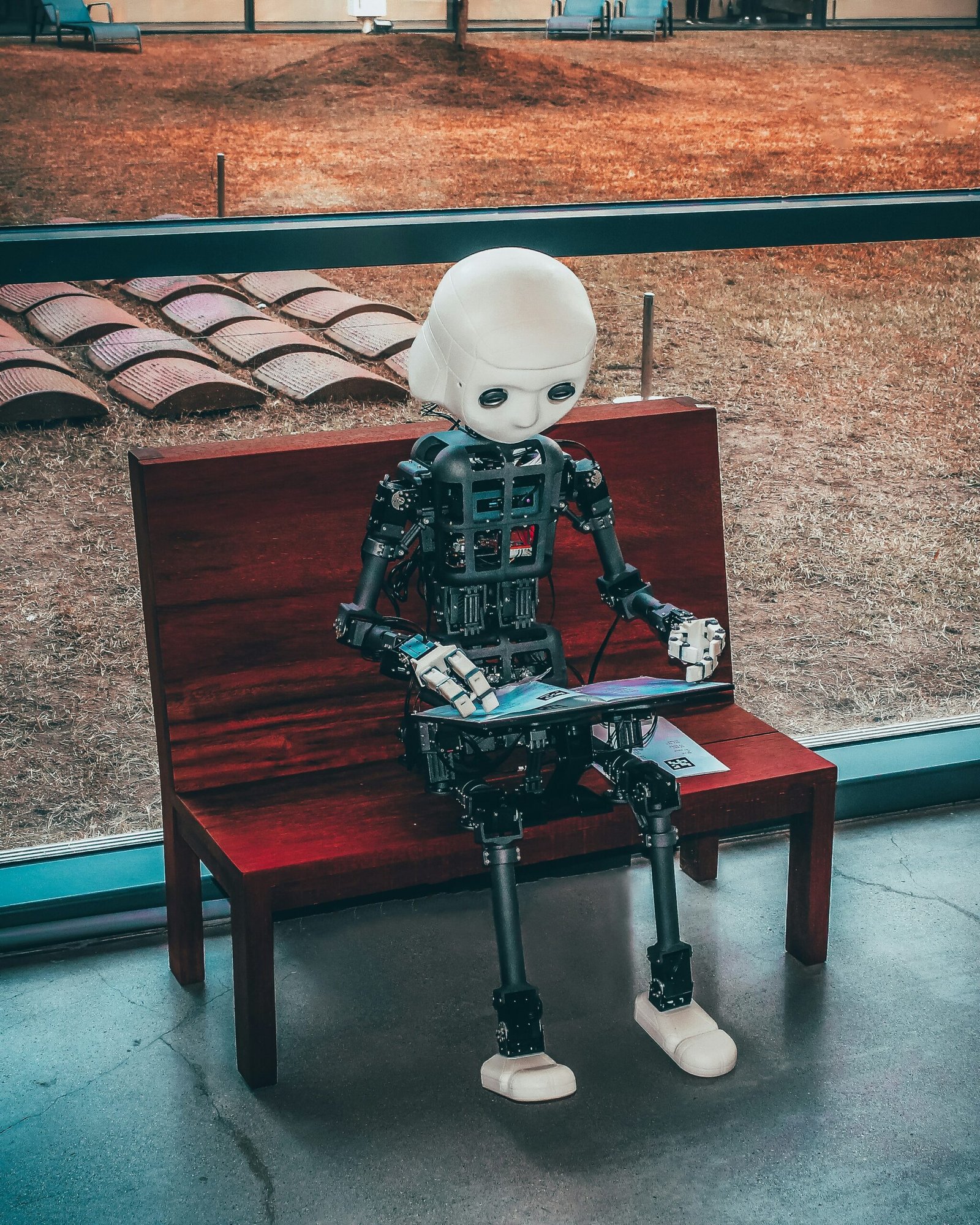

Artificial Intelligence (AI) is revolutionizing numerous industries, and the insurance sector is no exception. By definition, AI encompasses a range of technologies, including machine learning, natural language processing, and robotics, aimed at creating systems capable of performing tasks that would typically require human intelligence. In the context of the insurance industry, AI is being integrated to enhance operations, improve customer interactions, and streamline processes.

Insurance companies are increasingly investing in AI technologies to stay competitive and meet the growing expectations of their customers. One of the primary reasons for this investment is the potential for AI to significantly improve efficiency and accuracy. For instance, AI-driven automation in claims processing can expedite the resolution of claims, reducing the time and cost involved. Through machine learning algorithms, insurers can better assess risks and set premiums more accurately, ultimately leading to more personalized insurance products and services.

Customer service is another area where AI is making a substantial impact. Chatbots and virtual assistants, powered by AI, are being employed to handle routine inquiries, provide policy information, and guide customers through the claims process. This not only enhances customer satisfaction by providing instant support but also frees up human agents to focus on more complex issues.

However, the integration of AI in insurance does not come without challenges. One significant hurdle is the need for vast amounts of high-quality data to train AI systems effectively. Additionally, there are concerns about data privacy and security, as well as the potential for biases in AI algorithms that could lead to unfair treatment of certain customer groups. Despite these challenges, the benefits of AI in transforming the insurance industry are compelling, driving ongoing investments and innovations.

In summary, AI is playing a crucial role in shaping the future of the insurance industry. By enhancing customer service, optimizing claims processing, and improving risk assessment, AI technologies are paving the way for a more efficient and customer-centric insurance landscape.

Enhancing Customer Experience with AI

Artificial Intelligence (AI) is significantly transforming customer interactions within the insurance sector by fostering a more personalized and efficient service environment. One of the most prominent applications of AI in enhancing customer experience is the deployment of chatbots for customer service. These AI-driven virtual assistants are capable of handling a wide range of customer queries, from policy information requests to claims processing, 24/7. The immediate responsiveness of chatbots not only reduces wait times but also ensures that customers receive accurate and consistent information.

Beyond chatbots, AI is instrumental in offering personalized policy recommendations. By analyzing vast amounts of data, AI systems can identify patterns and predict customer needs more accurately than traditional methods. This data-driven approach allows insurance companies to tailor policies to individual customers, enhancing the relevance and appeal of their offerings. For instance, Prudential Financial utilizes AI to analyze customer data and provide tailored policy recommendations, resulting in higher engagement and satisfaction levels.

AI also excels in efficiently managing customer queries. Natural language processing (NLP) capabilities enable AI systems to understand and resolve complex inquiries that previously required human intervention. This not only streamlines operations but also frees up human agents to handle more intricate cases, improving overall service quality. Lemonade, an insurtech firm, has successfully implemented AI in its customer service strategy, achieving impressive response times and high customer satisfaction rates.

The impact of AI on customer satisfaction and retention cannot be overstated. By providing faster, more accurate, and personalized service, AI helps build stronger customer relationships. This leads to increased customer loyalty and retention, as satisfied customers are more likely to continue their policies and recommend the company to others. According to a study by Accenture, insurers that leverage AI for customer interactions see a significant boost in customer satisfaction scores and a reduction in churn rates.

In summary, AI is revolutionizing the customer experience in the insurance industry by enhancing service efficiency, personalization, and satisfaction. As more companies adopt AI-driven solutions, the benefits for both insurers and customers are expected to grow, setting new standards for customer service excellence in the sector.

AI in Claims Processing and Fraud Detection

Claims processing has historically been a labor-intensive and time-consuming task within the insurance industry. Traditional methods are often plagued by several challenges, including significant time delays and the potential for manual errors. These inefficiencies can lead to customer dissatisfaction and increased operational costs. However, the advent of artificial intelligence (AI) is revolutionizing this workflow, bringing about transformative changes in both claims processing and fraud detection.

Machine learning and predictive analytics, key components of AI, are at the forefront of these innovations. By leveraging large datasets, AI algorithms can automate the assessment of claims, significantly reducing the time required for processing. For instance, machine learning models can quickly analyze the validity of a claim by comparing it to historical data, identifying patterns, and making real-time decisions. This automation not only speeds up the claims settlement process but also minimizes the risk of human error.

AI applications in claims processing have shown remarkable success in streamlining operations. For example, some insurance companies utilize AI-powered chatbots to assist customers in filing claims, providing instant responses and guiding them through the necessary steps. Additionally, image recognition technology can assess damages from photos submitted by policyholders, offering immediate evaluations that would otherwise take days.

Fraud detection is another critical area where AI is making a significant impact. Traditional fraud detection methods often rely on rule-based systems, which can be rigid and limited in scope. AI, on the other hand, employs sophisticated algorithms that can detect anomalous patterns and behaviors indicative of fraudulent activities. By continuously learning from new data, AI models enhance their accuracy over time, making it increasingly challenging for fraudulent claims to go undetected.

For instance, predictive analytics can flag claims that deviate from typical patterns, prompting further investigation. Insurers can then prioritize these flagged claims, ensuring that genuine claims are processed swiftly while fraudulent ones are scrutinized more closely. This proactive approach not only protects insurers from financial losses but also maintains the integrity of the claims process.

In conclusion, AI is playing a pivotal role in transforming claims processing and fraud detection within the insurance industry. By automating tasks, reducing delays, and enhancing accuracy, AI technologies are setting new standards for efficiency and reliability, ultimately benefiting both insurers and policyholders.

Future Prospects and Ethical Considerations

The future potential of AI in the insurance industry is vast, with emerging technologies and trends promising to revolutionize the sector further. Advancements in machine learning, natural language processing, and predictive analytics are expected to significantly streamline operations, reduce costs, and enhance decision-making processes. For instance, AI-driven underwriting is becoming increasingly sophisticated, enabling insurers to assess risks more accurately and efficiently. Predictive analytics can help in anticipating customer needs and tailoring personalized insurance products, while chatbots and virtual assistants are streamlining customer service interactions, making them more responsive and efficient.

However, the integration of AI into the insurance industry is not without its ethical considerations and potential risks. Data privacy concerns are paramount, as the use of AI often involves large-scale data collection and analysis. Insurers must ensure they are compliant with data protection regulations and that customer data is securely managed and used transparently. Moreover, algorithmic bias is another critical issue. AI systems can inadvertently perpetuate existing biases present in the data they are trained on, leading to unfair treatment of certain groups. It is essential for insurance companies to continuously monitor and audit their AI systems to mitigate these biases.

Additionally, the rapid adoption of AI necessitates the development of robust regulatory frameworks. These frameworks should aim to balance innovation with ethical responsibility, ensuring that AI applications in the insurance industry are transparent, accountable, and fair. Policymakers and industry stakeholders must collaborate to establish guidelines that protect consumers while fostering technological advancement.

In navigating these challenges, the insurance industry has the opportunity to harness AI’s transformative power responsibly. By focusing on ethical AI practices, insurers can build trust with their customers and create a more inclusive, efficient, and innovative sector. Balancing the drive for technological progress with a commitment to ethical standards will be crucial in shaping the future of AI in insurance.